All Categories

Featured

Table of Contents

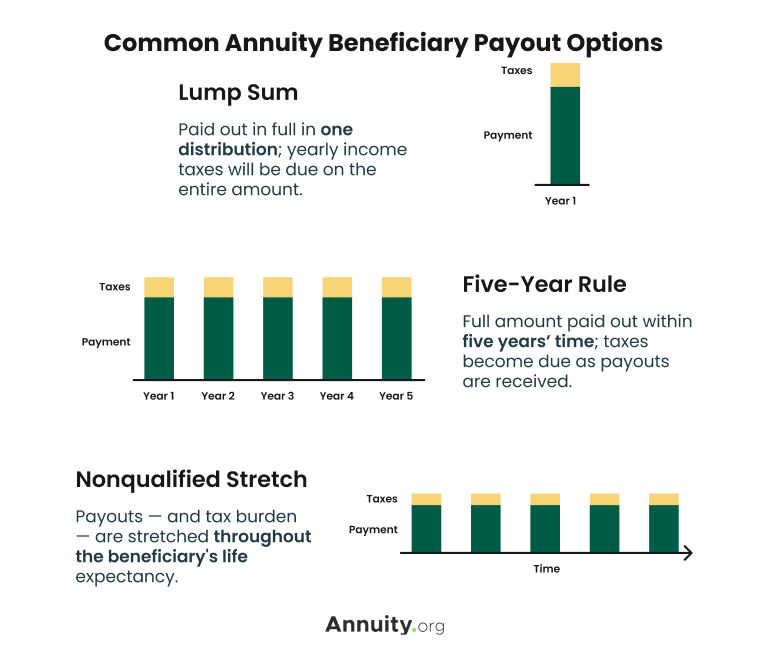

Understanding the different survivor benefit options within your acquired annuity is very important. Thoroughly review the agreement details or talk with a financial consultant to establish the certain terms and the most effective way to wage your inheritance. Once you acquire an annuity, you have several choices for obtaining the cash.

In some situations, you may be able to roll the annuity into an unique sort of specific retired life account (INDIVIDUAL RETIREMENT ACCOUNT). You can choose to obtain the whole continuing to be balance of the annuity in a solitary settlement. This option provides instant access to the funds yet comes with significant tax obligation effects.

If the inherited annuity is a professional annuity (that is, it's held within a tax-advantaged retired life account), you could be able to roll it over right into a new pension. You don't need to pay taxes on the rolled over amount. Recipients can roll funds into an inherited individual retirement account, a special account especially created to hold assets inherited from a retirement plan.

Is there tax on inherited Fixed Annuities

Various other kinds of beneficiaries typically have to withdraw all the funds within one decade of the owner's death. While you can't make additional payments to the account, an acquired individual retirement account uses a beneficial benefit: Tax-deferred development. Earnings within the inherited individual retirement account build up tax-free till you begin taking withdrawals. When you do take withdrawals, you'll report annuity earnings similarly the plan participant would certainly have reported it, according to the internal revenue service.

This option supplies a consistent stream of revenue, which can be beneficial for long-term financial preparation. There are various payment choices offered. Generally, you should start taking distributions no greater than one year after the proprietor's death. The minimal amount you're required to withdraw every year after that will be based upon your own life span.

As a recipient, you will not go through the 10 percent internal revenue service early withdrawal fine if you're under age 59. Trying to determine taxes on an acquired annuity can feel complicated, but the core principle focuses on whether the contributed funds were previously taxed.: These annuities are funded with after-tax bucks, so the beneficiary typically does not owe tax obligations on the initial payments, but any type of revenues collected within the account that are dispersed go through normal earnings tax obligation.

Tax treatment of inherited Tax-deferred Annuities

There are exemptions for spouses that acquire qualified annuities. They can typically roll the funds right into their own IRA and postpone tax obligations on future withdrawals. Either means, at the end of the year the annuity firm will certainly file a Type 1099-R that shows just how a lot, if any, of that tax year's circulation is taxable.

These taxes target the deceased's complete estate, not simply the annuity. These taxes generally just impact very large estates, so for most successors, the emphasis needs to be on the revenue tax ramifications of the annuity.

What taxes are due on inherited Joint And Survivor Annuities

Tax Obligation Treatment Upon Death The tax treatment of an annuity's fatality and survivor benefits is can be fairly complicated. Upon a contractholder's (or annuitant's) death, the annuity may go through both income taxes and estate tax obligations. There are different tax obligation treatments depending upon who the recipient is, whether the owner annuitized the account, the payout method picked by the recipient, etc.

Estate Tax The government inheritance tax is a very progressive tax obligation (there are lots of tax brackets, each with a greater price) with prices as high as 55% for large estates. Upon fatality, the IRS will consist of all building over which the decedent had control at the time of death.

Any kind of tax obligation in unwanted of the unified credit is due and payable nine months after the decedent's death. The unified credit rating will fully shelter relatively small estates from this tax obligation.

This conversation will certainly concentrate on the estate tax obligation therapy of annuities. As held true throughout the contractholder's life time, the IRS makes a vital distinction between annuities held by a decedent that remain in the buildup stage and those that have gone into the annuity (or payment) phase. If the annuity remains in the build-up stage, i.e., the decedent has not yet annuitized the agreement; the full survivor benefit ensured by the agreement (consisting of any type of boosted death advantages) will be included in the taxable estate.

Do beneficiaries pay taxes on inherited Annuity Fees

Instance 1: Dorothy possessed a repaired annuity contract issued by ABC Annuity Firm at the time of her death. When she annuitized the agreement twelve years ago, she chose a life annuity with 15-year duration particular. The annuity has been paying her $1,200 per month. Considering that the agreement assurances repayments for a minimum of 15 years, this leaves 3 years of repayments to be made to her boy, Ron, her designated recipient (Lifetime annuities).

That worth will certainly be consisted of in Dorothy's estate for tax obligation objectives. Upon her fatality, the repayments stop-- there is absolutely nothing to be paid to Ron, so there is absolutely nothing to consist of in her estate.

Two years ago he annuitized the account choosing a life time with money reimbursement payout option, calling his daughter Cindy as beneficiary. At the time of his fatality, there was $40,000 principal staying in the agreement. XYZ will certainly pay Cindy the $40,000 and Ed's administrator will certainly consist of that amount on Ed's inheritance tax return.

Considering That Geraldine and Miles were wed, the benefits payable to Geraldine stand for home passing to a making it through spouse. Annuity interest rates. The estate will have the ability to use the unlimited marital deduction to avoid tax of these annuity benefits (the worth of the benefits will certainly be noted on the estate tax form, together with a countering marriage deduction)

Is an inherited Variable Annuities taxable

In this case, Miles' estate would include the value of the remaining annuity payments, yet there would be no marital deduction to counter that incorporation. The very same would use if this were Gerald and Miles, a same-sex pair. Please keep in mind that the annuity's continuing to be value is figured out at the time of death.

Annuity contracts can be either "annuitant-driven" or "owner-driven". These terms refer to whose fatality will certainly trigger repayment of survivor benefit. if the agreement pays survivor benefit upon the fatality of the annuitant, it is an annuitant-driven agreement. If the death advantage is payable upon the death of the contractholder, it is an owner-driven agreement.

Yet there are situations in which a single person has the contract, and the measuring life (the annuitant) is somebody else. It would certainly behave to assume that a specific agreement is either owner-driven or annuitant-driven, but it is not that straightforward. All annuity agreements provided since January 18, 1985 are owner-driven since no annuity contracts provided given that after that will certainly be provided tax-deferred status unless it includes language that sets off a payment upon the contractholder's death.

Table of Contents

Latest Posts

Understanding Choosing Between Fixed Annuity And Variable Annuity Everything You Need to Know About Fixed Income Annuity Vs Variable Growth Annuity Defining Deferred Annuity Vs Variable Annuity Featur

Analyzing Variable Annuity Vs Fixed Indexed Annuity Everything You Need to Know About Variable Annuity Vs Fixed Indexed Annuity Breaking Down the Basics of Fixed Annuity Vs Equity-linked Variable Annu

Exploring the Basics of Retirement Options A Comprehensive Guide to Variable Vs Fixed Annuity Breaking Down the Basics of Fixed Index Annuity Vs Variable Annuity Pros and Cons of Indexed Annuity Vs Fi

More

Latest Posts